Faster, smarter mortgage settlements for Lenders

LegalStream streamlines the mortgage process, delivering a superior customer experience focused on speed and efficiency. From full documentation and settlements to high-volume discharges, we ensure a smooth journey to settlement.

Cutting-Edge Technology

Experience our digital offering incorporating market-leading technologies such as PEXA, DocuSign, and PowerBI. Our client portal, MStream, provides a comprehensive and customizable view of your entire process. Enjoy real-time reporting and seamless API integration with your lending platform, enabling two-way data flow.

LegalStream has transacted over 300,000 electronic settlements and consistently tops the PEXA panel solicitor leader board.

Partnering with DocuSign to securely deliver digital loan packs direct to customers, offering an end to end digital solution from instruction to settlement.

Simplified Complexity by Experienced Experts

Our talented team of industry experts understands the complexities and demands of your business. Trust us to ensure compliance at every step, providing data-driven solutions alongside leading-edge technology. Experience the benefits of increased productivity, efficiency gains, and a paperless environment with LegalStream's digital mortgage settlement processing.

In the event of mortgage defaults, LegalStream also offers lenders:

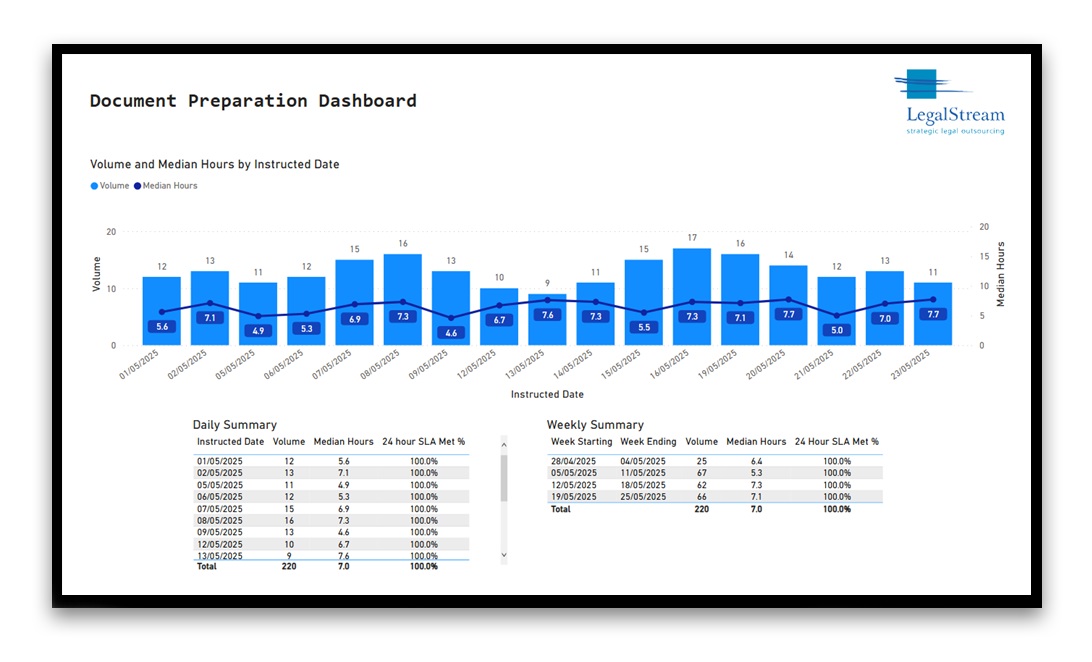

Stay ahead of the game with our Real-time Dashboards

We empower stakeholders with real-time dashboards, keeping you updated on progress and performance.

Contact us about this service

To discuss our Digital Mortgage Documentation and Settlements please contact

Joe O'NeillPhone: 02 9231 0122

Email: joe.oneill@legalstream.com.au

Other LegalStream Services

-

Mortgagee in Possession Services With nationwide expertise, we provide specialised services for secured recovery across all property types and jurisdictions. Learn More

-

Digital Settlement Solution Streamlined digital settlements for conveyancers and solicitors. Learn More

-

Mortgage Debt Recovery Innovative and cost-effective, our process prioritises effective communication for successful outcomes. Learn More

-

Online Search Services LegalStream is a licensed information broker authorized to provide online services for NSW Land Registry Services, NSW Office of State Revenue, ASIC, and Sydney Water Board. Learn More

-

Legal Agent Services 250+ law firms, government departments, and property groups nationwide trust LegalStream for online and offline legal services. Learn More